justice, peace and creation news

What is money today? No longer is it just the notes and coins minted by national Treasuries. It is also the securities and bonds produced by government financing agencies, along with the shares, debentures and other papers issued by publicly traded companies, that today cram the capitals markets. All these papers claim to represent real wealth, already produced or to be produced in the future. There are also other countries' currencies, known as foreign exchange, that have gained a market all to themselves, where feverish trading jams phone lines the world over.

Why do governments and companies produce these papers? Their intention is to accumulate liquidity in order to buy and spend more. As one form of money, the securities, bonds and shares seek to raise another form, cash. With money, they rent or buy money and, more and more, the economy hinges on money instead of real products. Once a means to economic activity, financial operations are becoming more and more an end.

What is the result when governments and companies produce these papers? The result is indebtedness. When the standard reference value was gold, cash was a debt security from the government to its bearer: in exchange for the currency, the bearer was entitled to receive a certain weight of gold. Today, cash no longer has a reference value. In a growing number of countries, one informal standard tends to be the North American dollar, but the dollar is money too, and so is also virtual by nature, until it actually comes to represent real wealth. In other words, any dollar in circulation not based on real wealth is virtual. If that dollar is virtual, then any currency that takes that dollar as a standard is virtual too, in a lengthening chain of virtuality and illusion, of purchasing power greater than the real wealth that exists to be purchased and therefore an inflationary chain, forever pushing up the price of real products.

Papers backed by that virtual currency whose standard is the virtual dollar are also virtual. Bearers of these papers expect a return, which they receive in the form of the interest they are paid as rent for their cash. Papers are an easy investment for them, because they do not require them to work in order to earn. The earnings come to them either through the work of others or through the cash which is also virtual for lack of underpinning in real wealth. The unregulated and unplanned growth of this activity of exchanging cash for money-papers and vice-versa has resulted in increasing speculation, finally creating a great air bubble in the world economy: a bubble of virtual moneys that are fuelling processes of spending and consumption by individuals, governments, companies and banks until the moment the bubble bursts. Now, other than dispersing the bubble, there is no way of preventing it from bursting or from causing an embolism in the system as a whole. This calls for political resolve and an active sense of ethics on the part of all those who benefit temporarily from the bubble. It also requires untiring pressure from those who are prejudiced by it and who will be the chief victims when it explodes.

The Brazilian government is a typical case. By way of a policy of extremely high real interest rates and buying up reals (Brazilian currency) on the financial market in exchange for Treasury and Central Bank securities and bonds, the Fernando Henrique Cardoso government has increased Brazil's internal debt almost sixfold, from R$60 billion in January 1994, when Cardoso took office, to R$373 billion in November 1998. The interest payments on this debt reached R$ 330 billion during the period and have been excruciating for the country's economy. Cardoso built a financial and investment policy on foreign saving, in an endeavour to attract foreign investors' dollars to bridge the gaps in its own accounts. When the crises in Mexico, then in Asia, and then again in Russia, placed these investments and the real's artificial stability in jeopardy, the Cardoso government disregarded the danger warnings. In order to attract this capital which, avid for easy gains and fearful of losing them, was devastating those economies and which would also threaten to devastate Brazil's economy instead of creating instruments to control and regulate the inflow and outflow of foreign capital, the government preferred to raise interest rates and even to offer tax exemption to foreign exchange applications. The Brazilian government was irresponsible and reckless and, as a result, its bubble burst on January 12, 1999, threatening to drag other Latin American economies, and even perhaps the USA's, down with it. The Real Plan died there, and Brazil was plunged further into bankruptcy.

Today the bubble of international speculation is formed by all the moneys that circulate rapidly around the world chasing opportunities to reproduce without effort, without productive work, without creating real wealth, merely by changing hands, by speculating with foreign exchange, with products that are to be produced and traded in the future, foreign debt securities from indebted countries, and even money from drug trafficking, the arms trade and other illegal and immoral activities. The total sum of all these has not been measured accurately, but today is estimated at nearly US$100 trillion!

A wide range of agents are inflating this bubble. Much is said today about "popular capitalism" in the USA or in Switzerland, where millions of individuals own company shares, government bonds, foreign debt securities, foreign exchange, and so on. The main agents, however, in terms of both the quantity of moneys they wield and the frequency and speed at which these moneys circulate, are the big banks and investment companies, the pension funds and other types of private, and even State, institutional investors. It is they who are responsible for the bubble. And their favourite theatre of operations are the capitals markets set up in the poor world and Eastern Europe in the image and likeness of the capitals markets of the highly industrialized countries. It is they who today stroll their virtual moneys around the world, triggering crises wherever they go, speculatively attacking local currencies, not just when they pull out, but from the moment they enter each economy's domain. Speculative withdrawal would be the most appropriate name for these agents' headlong rush to pull out of a country's capitals markets. Scared? Yes, scared of losing their easy profits.

In mid-January 1999, a small investor in Switzerland showed me his bank statement: he had applied FS6,000 in the portfolio management bank where he worked and, three days later, he redeemed the investment: to his surprise the value had risen to FS7,300!!! A return of more than 21% in three days! What kind of activity could produce a gain of that size that effortlessly? What country or institution could pay interest at that rate? None. It is pure speculation with foreign exchange. With the information that a currency is to be devalued, you invest in foreign exchange and then buy back the local currency after devaluation. And what currency was suddenly devalued in mid-January? The Brazilian real, which lost 25% of its value against the North American dollar between January 12th and 19th and, on the 22nd, had already lost another 18 percent! This is a typical example of exchange speculation. At the root of this speculation there is thought to be some Brazilian government official or other who "tipped off" his international "partner"... That is how the world financial system works today. This is a clear example of the logic and the ethics of capital: whatever multiplies capital gains is valid and good, including speculation and corruption; while everything that hinders them is bad or stupid.

The unlimited right of governments and companies to issue these papers has led to the world's markets being inundated with virtual money, because a large part of the papers are launched on the supposition that, sooner or later, the government or company will be able to turn them into real wealth and so redeem them for the value that they are supposed to represent. This supposition belongs to the subjective sphere of the economy, that which operates on the basis of non-material values like confidence, foresight, hope and so on. Now, when the government or company does not manage to repay the bearer of their moneys, it becomes insolvent, thus proving that the supposition was false and that the confidence and hopes deposited in them were mistaken, for lack of proper planning, rules and supervision to ensure that the game was played correctly and cleanly and because their moneys were only virtual.

In fact, they are as virtual as the chips in a casino, which are equivalent to a certain amount of cash, but not necessarily to real product. The economy of a casino is a circle of virtuality, but even there there has to be planning. If the casino puts into circulation a greater value in chips than the value of the money it expects to collect from its customers, including what will go to pay its operating costs and cover payments to owners and employees, the casino is at risk of going broke. The economic rationale of a casino thus includes a limit on its freedom to issue currency (chips): that is, its capacity to enter into debt with its customers.

Today we are witnessing a casino economy at the world level and, with it, an almost unavoidable risk of worldwide financial, social and economic crisis. A gigantic amount of money circulates around the world in various forms, with no backing in real wealth. Also it is circulating in more and more virtual form; that is, on computer screens instead of papers in the hands of its bearers. Ever since electronics has enabled these moneys to be exchanged via computer, they have been circulating at a dizzying speed. Today, anything securities, bonds, shares, etc. and even cash in the form of foreign exchange can be exchanged by electronic means. And these moneys can be issued and circulated free from restrictions, from any effective regulations, even though Central Banks do impose certain rules on companies and banks designed to limit this freedom. When such rules do exist and are made to work, companies' and banks' indebtedness tends to be viable. When governments impose rules on themselves to limit their right to enter into debt and then comply with those rules they also tend to remain solvent and manage their nation's economy feasibly and competently, as demonstrated by the municipal government of Porto Alegre, in Southern Brazil.

This no longer happens in the world of financial globalization, however. Governments, companies and banks throughout the world are over-indebted and at risk of bankruptcy. Even the rich countries or the banks and companies that hold most assets have accumulated debts that are leading them, sooner or later, to the moment of truth: either they pay up or go bankrupt. In order not to go broke, governments cut back on their investments, particularly in social programs, and raise taxes. Switzerland, the country with the highest per capita income in the world, a haven for clean and dirty money from all over the world, is a good example of this. Claiming lack of funds, the governments of the confederation and cantons have systematically cut social investment. Recently, the Swiss government announced a one percent increase (from 6.5% to 7.5%) in VAT to offset a 1998 budget deficit of FS 7.6 billion. It later apologized to the public, explaining that there had been a "miscalculation" and the deficit was in fact only FS 300 million. Nonetheless, it did not reimburse the taxpayers nor lower the tax rate. Some months ago, the Japanese banking system was plunged into a severe crisis by the over-indebtedness of the real estate sector. The North American government operates with high levels of indebtedness but, last October, it did not hesitate to bail out the private financial group, LTCM, specialists in speculation, with a package of US$ 3.5 billion culled from public funds. Companies and banks of all sizes, when on the brink of insolvency, often merge with, or are bought out by, others that are sounder at the time. Today we are witnessing a snowball of mergers and buyouts that point to a global economy that, in just a few more years, will be highly concentrated and monopolized... until the bubble bursts.

Neoliberal ideology has shaped the environment for the globalization of financial capitalism. It holds that the laws of the market are universally valid for all spheres of human existence. Everything, including money, should be treated as merchandise, and the market should be left free in order for goods and money to circulate properly. In this way, the market will meet all needs and effectively distribute the wealth produced. All regulation is unwelcome, because it prevents the free flow of goods and money. That is the content and sense of the villainous Multilateral Investment Agreement which was being drafted and discussed in secret by the wealthy countries. In practice, neoliberal capitalism is responsible for the casino-economy that has globalized in the world today and for the extreme enfeeblement of the State's regulatory role and social function.

In the 80s, for a number of reasons, the indebtedness of countries of the Southern hemisphere, made possible by the irresponsibility of both governments and their creditors, reached the point of insolvency. In exchange for rescheduling these debts, the creditors imposed rules whose prime objective was to liberalize the debtor countries' economies and markets, that is to say, they imposed rules to eliminate rules, to neutralize governments' power to regulate and sanction, including the liquidation of public patrimony by privatizing and denationalizing State enterprises. In this way, governments of very indebted countries, which were generally those with the higher poverty rates and the longest histories of colonial subordination, exchanged real wealth for virtual wealth. Many took out new loans in the 80s to pay off previous loans, and not to invest in creating new wealth or the capacity to produce it. They became trapped into a vicious circle of indebtedness from which they were never going to escape, at least not by the end of this century.

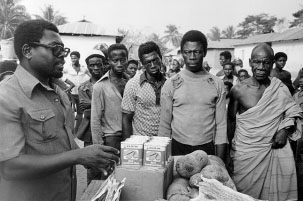

| The over-indebtedness of the countries of the Southern hemisphere, now accompanied by those of Eastern Europe, constitutes a modern form of colonization. They are obliged to service the debt to their creditors in the North to a seemingly limitless horizon, as if they were paying a regular tribute to a colonial metropolis. There is one important difference, though: these metropoles are no longer only colonial or imperial powers, but also private companies and banks based in the rich countries, plus the multilateral financial institutions the World Bank, the IMF and the regional "development" banks. |  A Christian Council of Ghana representative distributes food to Ghanaians forced to leave Nigeria. (1983) |

The real solution for the world, particularly for those who live mainly by their work, lies in summoning up the courage to break with neoliberal capitalism and, in the last analysis, with capitalism itself. This means several things: imposing limits and rules on capital flows and on the issuing of different forms of money; setting up institutions at the national and international levels capable of enforcing these rules and sanctioning agents that break them; adopting an investment policy that will make self-managed models of development viable from the community to the national levels; adopting a policy of progressive taxation, capable of encouraging domestic consumption and production and of discouraging speculation by redistributing wealth and investment; radically reforming the international financial institutions, their principles, functions and way of operating; restoring control over each family's and each community's finances to themselves, by multiplying cooperative savings and credit institutions and by passing appropriate legislation to support them; restoring the power to plan development, from the micro to the macro levels, by using finance as merely a means because the end should always be individual and collective human development.